Happy New Year everyone! Yes, it does get a little bit old saying Happy New Year as we’re into the middle of the month, but I do need to confess that I was away last week! I would have normally had this out by last week but being away I obviously didn’t get this done, so we’re doing it this week instead. I usually go away at this time of the year because it’s a great time to get away and reflect on the year, to rest and recharge my batteries for the new year. It also gives me a little bit of time to do some reading! I was reading Matthew Perry’s book, Friends, Lovers, and the Big Terrible Thing. It’s quite a good read if you’re looking for something to pick up this month.

But I’m not here to talk about reading and vacations, I’m actually here to talk about the market and 2023 real estate; what does it look like, where is it going, and what does it mean. There’s a lot of headlines out there right now which makes it difficult to really weed through it and understand what it all means. So, I thought I would raise a few points here today and just go over a few things and try to shed some light on what I think about where things are going, and also to give you maybe an overview of year-over-year, 2022 to 2023.

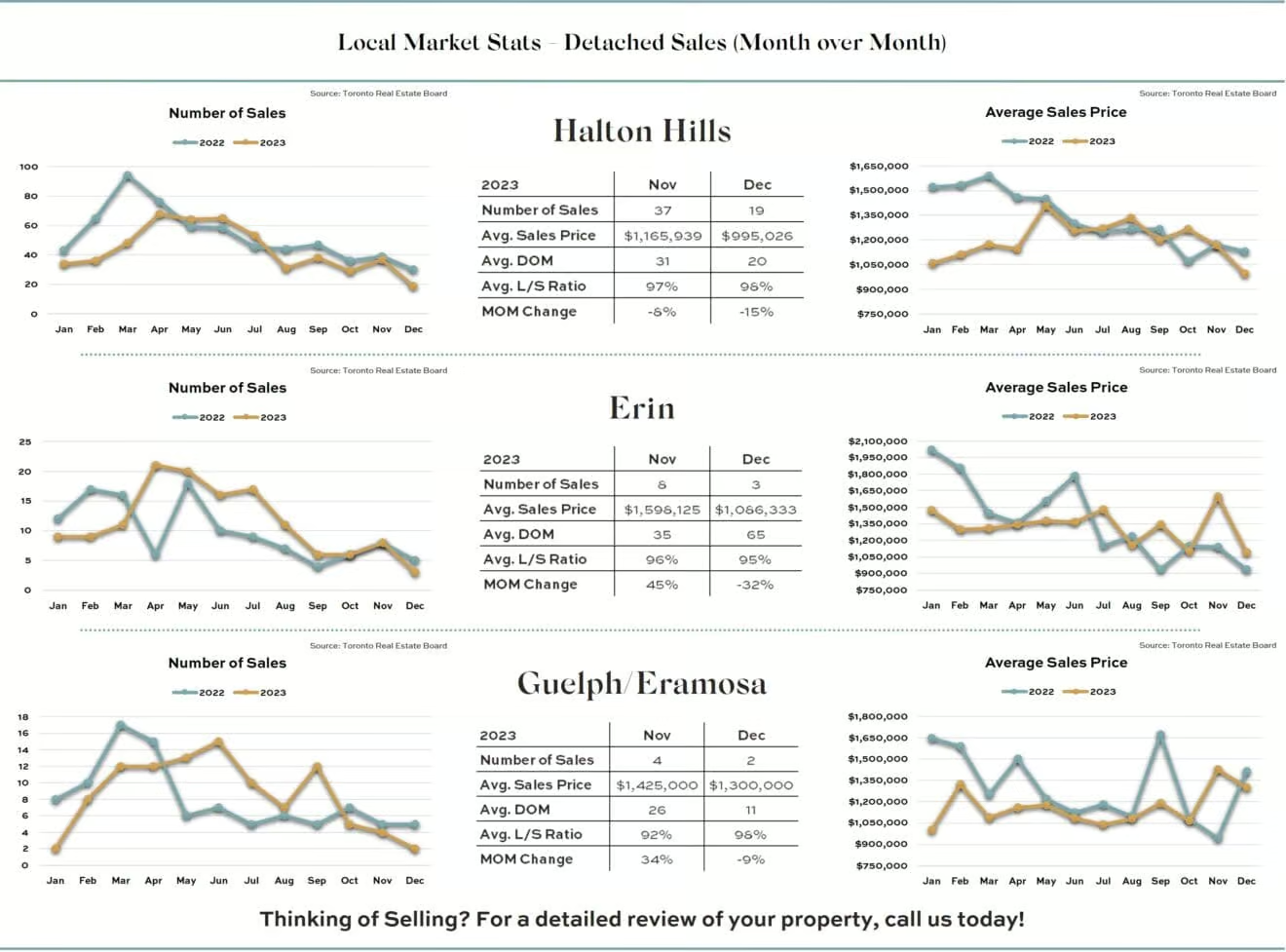

So, in our key market areas of Guelph/Eramosa, Halton Hills, and Erin Hillsburgh, what did 2023 real estate look like. Well, most of you have seen the headlines and are aware of the impact interest rates had. We saw those rate hikes continue throughout the year as every announcement came out. Of course as we saw that, we saw prices starting to shift downwards, and we saw buyers moving to the sidelines. It became a bit of a challenge to get what the buyers wanted to pay for something, in line with what a seller was willing to accept. So getting that connection at some times was a very big challenge, the last quarter of 2023 especially, and I think we saw one of the slowest and quietest that we have seen in quite a few years now.

As we head into 2024, we do have another rate announcement expected for the end of January, and I suspect at this point we’re going to see those rates hold. In 2024 I think we might see some softening of those rates, maybe into April and into the second half of the year. Which, may bring some of those buyers who have been sitting on the sidelines back to the table, willing to participate in the market again, and bringing some confidence back into the market. I do think as well that we have already seen an increase starting into the new year, which I think the New Year always brings new life, new hope, new vision. I think we’ve seen some of the showing activity increase on quite a few properties already, which is indicating that there is some movement and buyers coming back, maybe even before the typical spring market.

One of the things I think we also had to get used to, was what this new normal looks like. We’ve had to get adjusted to these new rates, and we’re not going to see those record low interest rates for quite some time—if ever. So, it’s been an adjustment phase for everyone and we’re finally starting to get there, I think.

As as an overall big picture, Royal LePage is actually forecasting a 5.5% increase in the average price, year-over-year, for 2024. I think that’s a positive outlook and we’ll see how things play out as the year goes on.

To finish up, I wanted to talk a little bit about what happened 2022 to 2023 in our key market areas of Erin/Hillsburgh, Guelph/Eramosa, and Halton Hills. For detached homes the number of units sold in 2022 was about 850 homes. Now in 2023, we only saw 761 homes sold, so that was a decrease of almost 90 units. That’s a pretty big sway. The other thing we saw was a decrease in the average sale price, which went down about 11.3% to around $1.23 million for your average detached home. No surprise to anyone, we saw the average days on market increase last year, and we went to about 24 days on market to get sold, an increase of about 6 days over the previous year. But, I think when you really look at it, 24 days on average to get sold is very manageable and a comfortable time frame. Again, these are just averages to give you an idea, but I think that’s very realistic. We also saw a decrease in the list-to-sale ratio (what price a property was listed for vs. what price it actually sold for), it actually went from an average of about 105% in 2022, down to 98% in 2023. That’ a decrease of about 6%, but if we remember what happened in 2022, the first quarter was pretty strong. We were seeing multiple offers still, and the heated market continued from 2022, so a lot was actually still selling over asking. It was only in that last part of 2022 that we started to see the push downward on prices and the change in the market, so that’s why that year still shows pretty strong. For that reason, I think these numbers are a tiny bit skewed, although they do show the picture year-over-year.

If you want to know what 2023 real estate (or now) was like for your particular property and in your particular market area then give us a call, we are happy to go through that with you and help you understand where things are at. And of course as a buyer it’s also helpful to get some information understand where things are at, so if you’re in the buying seat give us a call—our team is always here to help!

– With gratitude, Lisa Hartsink

Get Started Today

Buying or selling in Halton Hills and Georgetown? See what the Lisa Hartsink Team is all about and how we can help you.