When you think of someone searching for a home, you might picture a young, bright-eyed first-time buyer who is excited to take on a bold new chapter in their life. Or it could be a growing family on the hunt for something bigger or in a more established neighbourhood.

However, there is another demographic that is on the move. Long-time homeowners and retirees make up a significant number of real estate transactions in the market today.

Many people preparing to downsize have not bought or sold a property for some time, and much has changed in the industry over the years. Although anyone could use a refresher about the home-buying process, today’s post is dedicated to the mature property owner who is ready to move on to something new.

Believe it or not, downsizing can be a smooth and seamless process. At least, it can be when you download our Downsizing Guide to lead the way.

Buying a Home in Ontario 101

If you’ve been in the same place for some time, the process of buying a house begins with the big picture. Before diving into the nitty-gritty of how many bedrooms or bathrooms you prefer, start with a review of the market itself.

You can find the latest statistics on the various real estate boards, which will tell you what types of houses are selling and at the average prices. The Lisa Hartsink Team is happy to help you make sense of these numbers and understand what they might mean for you when you’re ready to buy. For example:

- We might be in a seller’s market. This means you may face competition from other buyers, and will have to work harder to make your offer compelling. On the plus side, it could also mean you’ll enjoy a very successful sale of your existing home.

- It could be a buyer’s market. Plenty of listings are available, and you can take your time choosing what’s right for you. As an added bonus, sellers might be willing to negotiate with you.

- The market might be balanced. Sellers and buyers are more or less equal. In this situation, a real estate agent can dig deep to uncover any and every advantage you may have.

Are you considering downsizing? Learn more about the when, how, and where in the posts below:

- Downsizing Your Home for Retirement in Any Type of Market

- Renting Vs Buying a Home in Retirement

- The Empty-Nester’s Guide to Selling Your Home

Factors to Consider When Buying a House

Some of the things to think about when buying a house are obvious. It’s easy to see what attributes align with your life right now. If you have a passion for gardening, a backyard with room for a toolshed may be non-negotiable. Or you may prioritize access to shops and services without having to drive too far, if at all.

However, you should also plan for how things might change over time and plan for the long term.

When we counsel younger buyers, we make sure they understand that they might want more space later on. For older buyers, the opposite is often true. You may end up wanting less space for easier maintenance. Consider also how your health and mobility may change as you age. There could come a time when you want everything all on one level.

A strategic choice now can prevent an unwanted move a few years down the road. For example, let’s say you want extra space so you can entertain and host guests, but you still want to be prepared for the future. Perhaps a bungalow or a multi-bedroom condo will suit your current and future needs.

That’s not to say that you can’t move later on. Some people buy a house just as a stepping stone, like snowbirds who plan to spend as much time as possible in the tropics. What we want to avoid is a move that is unwanted or unplanned.

Everyone is also different, and not every retiree wants to downsize. In some cases, they actually want to buy a larger home. Think of the future options; you can enjoy the extra space now. Later on, there’s the potential to age in place by having a family member or caregiver move in. You might even consider a property with a secondary suite, or at least the potential for it.

Looking for more home-buying tips? You’ll find plenty in the related reading below:

- Why Title Insurance Is so Important for Homebuyers, and What Most People Don’t Realize

- The Advantages of Buying a House in Halton Hills

- Should I Buy a House With an In-Law Suite?

For your convenience, we’ve outlined the major steps to buying a house in Ontario below. If you want even more detailed instructions, be sure to download our Home Buyers Handbook!

Home Buying Checklist

- Be sure to account for all of the costs associated with buying a house. If financing, you’ll need a down payment and a deposit. Closing costs will include land transfer taxes, legal fees, and possibly mortgage insurance. You can estimate how much you will need to close with our buying calculator.

- Begin packing and decluttering your existing home early. Think of what features you want in your new house. Focus on attributes that can’t be changed, like the layout and location.

- Think of what you don’t want. Some buyers want a sprawling backyard; others want to avoid the work involved at all costs.

- What city do you want to settle down in? What neighbourhood?

- When do you want to move and how long do you want to stay?

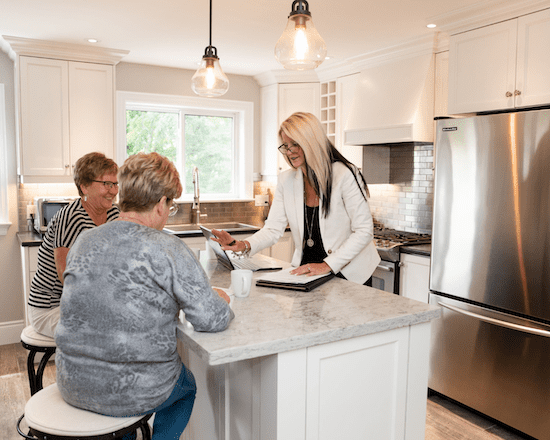

Buying a home can feel like a big task-because it is. The key to never feeling overwhelmed is to surround yourself with support right from the beginning. This includes emotional support from friends and family. It also means having a team of experienced, compassionate real estate agents and other professionals in your corner.

Together, you can make short work of all items on your to-do list and you’ll soon be on to your next adventure.

Do you want personalized guidance through all the steps to buying a home? Our Georgetown real estate agents can help. Give us a call directly at 905-873-9944, email us at info@lisahartsink.com or fill out the form on this page to get in touch!

Get Started Today

Buying or selling in Halton Hills and Georgetown? See what the Lisa Hartsink Team is all about and how we can help you.