There is a lot of confusing information out there in the marketplace right now, and many are feeling unsure about mortgage affordability in this changing market. Do I buy now or do I wait? Rates are up but prices are down. When is the best time to buy? The best answer is when you can, and the opportunity is much better today. It’s really not all doom and gloom if you want to get into the market today, this correction is exactly what a lot of Canadians have been asking for, for years!

Looking for more guides to buying, selling, and beyond? Download our e-books right here!

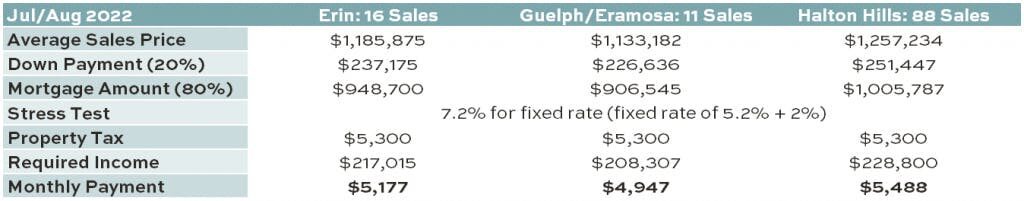

Let’s take a closer look at things and help you through this. When you look at the real numbers, your purchase price is lower so you don’t have to save as much for your down payment. Saving a large down payment can take many years. In some cases your mortgage amount is lower, and your monthly payment is lower even with the higher interest rate. Let’s look at the key market areas for Lisa’s team as an example, comparing the peak market of January/February 2022 with the last two months; July/August 2022.

So, if you were prepared to purchase a property during the peak and you apply the same down payment to the new sales price averages in the example below, you would actually have more than $100,000 less mortgage to finance and the numbers are actually more attractive!

What those numbers reveal if we look at Erin for example…

- 44.8% reduction in the number of sales from the peak compared to the last 2 months

- 38.4% reduction in average sale price from the peak to the last 2 months

- 14.1% reduction in the required income to qualify for a fixed rate with lower sales prices

- If you keep the down payment at 20% on the current average sale price ($237,175), you still have an approximate 24.9% decrease in your monthly payment

- If you keep the original down payment ($385,086) on the current average sale price, you actually have an approximate 38.4% reduction in the required mortgage amount

- With the above noted shift, technically the mortgage amounts have been reduced by approximately $591,645 based on the difference between the peak to now. In terms of mortgage payments, that’s like shaving about 17 years off the amortization of your mortgage before you even get started! Crazy! So, no time like the present!

In trying to analyze this even further, I would say we are seeing an average price decline of approximately 17.1% for every 1% increase by the Bank of Canada. This is not an exact science however, but simply comparing the 38.4% decline over this region in relation to the 2.25% increase by the Bank of Canada (as of August 31st) this is what the numbers show.

Read more homebuying blogs with these posts next:

- Why Title Insurance is So Important for Homebuyers

- 8 Things to Know Before Buying a Home in a Rural Area

- Assessed Value Vs. Market Value: What’s the Difference?

You typically get lower home prices with higher rates and higher home prices with lower rates. I personally would rather have less mortgage debt to carry and finance, coupled with a higher rate because it takes decades to pay off hundreds of thousands in mortgage debt. You want to marry the Home and date the Rate. What goes up must come down and given the economic storm that is circling the Globe, we are likely in for a Global Recession that will probably require interest rates to be dropped to eventually stimulate growth or weaken our currency to promote our exports like the Bank of Canada did for the oil crisis in 2014. Will be interesting to see what happens in 2023.

All this being said, do you wait to purchase in 2023 then? No, I would suggest if you can purchase now, do purchase now. And, if you did purchase in the peak, is that bad news? No, all is good there too. If you sold and bought in the same market you are on equal ground (buy high, sell high/buy low, sell low). If you bought as a first-time home buyer during the peak, you are in the game and have started to build your equity. You need to start and it’s important to start. Your money is already working for you. You will ride out the highs and lows and if you stay in your home for the next 3-5 years you will be in good shape.

So, what is a pre-approval and why do I need it?

Pre-approvals establish the amount of mortgage you may qualify for, provided your financial situation does not change. It also guarantees the interest rate for up to 120 days for most lenders.

With the upcoming Bank of Canada rate increases scheduled for October 26th it is important you lock in your rate if you are looking to purchase in the near future. The prime rate can still increase and if you purchase after the prime rate increase, this could reduce the amount of mortgage you qualify for.

If you aren’t sure what your plans are yet, not to worry! Here’s a snapshot of what things could look like to help you plan. We estimate that the next rate increase will be approximately 0.50% on October 26th, 2022 and this translates to an increase in mortgage payments of roughly $25 to $42 per month for every $100,000 of mortgage you want to finance.

Connect with your mortgage professional to re-run your qualification numbers and get set up in the right direction. For now, I would say you will probably still qualify for more with a variable rate rather than a fixed rate. However, if you are not sure which option is best for you, give me a call today and I’m happy to help you! Need a second opinion? I’m here to help with that too!

Michael Pasquarelli, Mortgage Agent

Dominion Lending Centres Clear Trust Mortgages Inc.

www.treeviewmortgage.ca

With 16 years of hands on Banking experience, Michael works diligently on client files to find the best solution. Strong core values from his time spent in the bank and a universe of lending options allows him to truly do the right thing for his clients. All of this results in a 5-star referable experience!

Michael and Lisa have worked together for approx. 5 years and share a passion for building relationships, and helping clients make the best choices for their unique situations.

Still have questions? Get in touch today by calling 905-873-9944, emailing info@lisahartsink.com, or fill out the form on this page.

Get To Know The Team

See what the Lisa Hartsink Team is all about. Get to know our inner circle and how we operate in Real Estate, and the community.